Global Insight

What is this page?

Global Insight is our dedicated space for exploring international dynamics that directly or indirectly influence global supply chains and commodity markets.

From monetary policies in major economies, energy price fluctuations, geopolitical tensions, to evolving trade regulations — we deliver sharp, relevant insights designed to help our partners make smarter trade decisions.

Here, you’re not just reading news. You’re gaining context, direction, and strategy.

Why Bank Reputation Matters

Fact vs Origin Debate

Why Sellers Prefer CIF

Choosing the Right Instrument in Commodity Trade

Avoid Delays & Maximize Profits

Understand the Real Process

SBLC acceptance in trade depends on the trust behind your bank. Sellers evaluate the issuer before pricing — not just the document…

CIF vs FOB in sugar trade: sellers prefer CIF due to control, risk reduction, and clean payment processes. Here’s why FOB rarely works in large sugar contracts

ICUMSA 45 sugar specification is global. Origin doesn’t change purity. Learn what matters: quality, terms, credibility—not just country.

SBLC vs DLC in commodity trade: know when to use each, their impact on risk and execution, and why one suits structured trade better than the other.

Brazil sugar shipping to Jebel Ali requires precision. Learn how to reduce delays, cut demurrage, and protect your trade margins.

Confused about GACC exporter CIF China rules? Learn why China tracks the importer, not the exporter—and how to avoid common mistakes in trade.

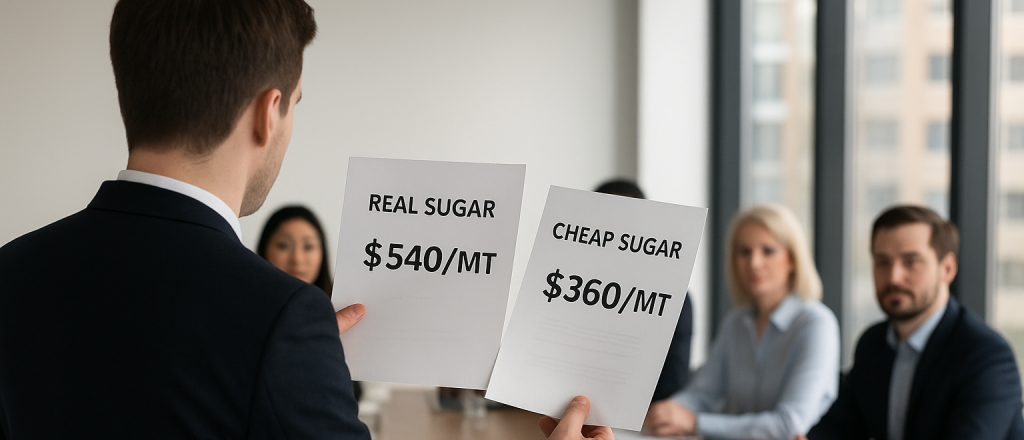

Learn why there are no “cheap” Brazilian sugar prices in 2025 and how to identify real sugar offers from verified exporters.

Buy molasses 2025 Now : Soft Price, High Availability, and stable freight create a rare buying window before price rise in 2026